Basic Workflow Model To Consider During Cash Advance App Development

home / blog / Basic Workflow Model To Consider During Cash Advance App Development

The Banking and Finance Services Industry (BFSI) has different layers and branches. There is a range of financial services part of the BFSI unit. All banking services to money lending services come under the same industry. Cash Advance App Development is one such money lending app.

Money lending is a loan format provided by banks and other money lending firms specialized in the business. Lenders have the necessary cash amount, and users can apply to them for a certain amount, which they can pay back over a certain period. Cash Advance App Development digitalizes the whole process of money lending and paying back.

The difference between a regular cash lending application and a cash advance app is that the user borrows the money in advances from their next paycheck. So, technically, the user is not taking money from a third party but makes a deal with the app and pays back as soon as the following month’s paycheck gets credited. As no third party is involved, these apps often don’t charge any interest, but they could include monthly, quarterly, or yearly subscriptions.

The whole process of Cash Advance App Development requires understanding each segment. We will start with the workflow of an advanced cash application. The workflow entails the digital process of how the app is supposed to work. These instances are explained in the steps below.

Step1: For using the services provided by the application, the user needs to register and sign-up for the platform. The registration process is quick, often having a social media sign-u[p feature to accompany it.

Step2: The user must go through different verification processes before getting his share. During the Cash Advance App Development, these verification processes are layered one by one; bank account verification, KYC verification, and a few more.

Step 3: As a Cash Advance App that only lends money from your upcoming paycheck, the lending limit is set upto a point. The app will allow the user to check the lending amount and then decide on whether to apply for it or not.

Step4: If the user agrees with the lending limit and other charges included, they can proceed to apply for a cash advance.

Step5: The user can pay the lent amount when their salary gets credited. Usually, Cash Advance App Development ensures a handful of automatic features. For example, the user’s payment can be automatically deducted from their bank account as soon as the paycheck arrives, without the fear of missing out on deadlines.

Cash Advance App Development: Features

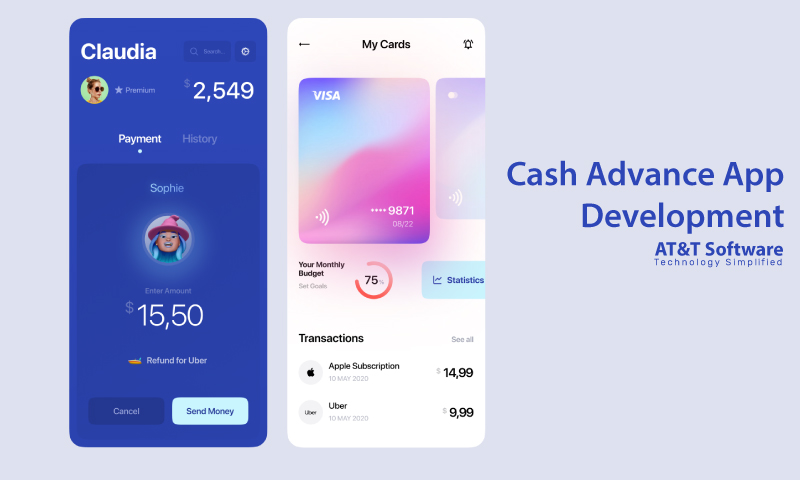

A Cash Advance App is developed based on multiple factors. It needs to have a workflow, a revenue model, and various features to accompany the whole system. These features are crucial for the functions, and the user interface is designed to put all these thoughts and actual processes together. So, let us go through the list of features that could be included in a cash advance application.

User Sign-Up

As stated in the workflow, the user cannot avail of any services provided by the platform unless they have registered. During Cash Advance App Development, the registration process is specifically designed more straightforwardly so that users can quickly join the platform. Users are just required to fill up their credentials such as phone number, email i.d, or even register through their social media handles.

OTP Verification

Probably the registration process has been made simpler due to the complex verification processes that follow. When registering, all the credentials provided by the users get verified by the platform. The user’s email i.d or phone number is automatically sent with an OTP, which they need to put back into the app platform to complete the verification procedure. If the password is deemed correct by the app, the user will be allowed head on to the next stage.

Create Profile

Cash Advance App Development primarily focuses on customer profiles. After completing the verification process, the user is provided with a personal profile. This profile holds vital info about the user, which the app requires to provide services to the user. The data can be edited and changed by the user with valid updates.

KYC Verification

The user profile also holds the KYC info of the user. KYC is a different type of identification that a user can include in their profile. These identifications are to be verified by the app platform, and once that is over, these proofs of authentication can be added to the user profile.

Bank Account Linking

As a financial service app, linking bank accounts is a basic necessity. The app and user can carry out this transaction only by linking the bank account of each user. In the case of Cash Advance App Development, the system revolves around the salary account of the user. The user of a cash advance app borrows the money in advance from their salary, including the user’s salary account is often necessary.

Lending Amount Calculator

Whatever the user wants to borrow has to be borrowed within a certain amount. And since the whole process of a Cash Advance App is centered around the user’s paycheck of the next month, from which he supposedly takes an advance. So, there is a limit to it, and the app calculator shows the exact limit that that individual can borrow.

Transaction Detail

The user can avail of the platform multiple times. The server contains every detail of every transaction. The user can access their bit of the transaction history from their profile.

Invoice Generation

Every transaction will have an automatic invoice generation, through which users can view any invoice they wish. This is also another way to keep track and has written proof of the transaction that has been processed.

In-App Wallet

It is essential to include an in-app wallet during Cash Advance App Development. As a financial service app, the app needs a wallet. These wallets are individually allotted to users. They can store digital cash transferred from their bank account or borrowed from the app within the wallet. Some apps may only send the borrowed sum in their wallet, which the user is required to get transferred into their bank account to use the money for whatever cause.

Payment Gateway

The app must have a secure payment gateway. It could also ensure multiple payment processes that will give users more flexibility. The transactions from both sides are done through the payment gateway provided by the application. Safety is the topmost priority to consider. This will surely help build customer trust.

Investment Tips

Cash Advance App Development is primarily focused on the experiences of the user. There is always something innovative that the app may try to do. And one such instance may be providing investment tips to the users. The user can choose from a few possible options, while the platform itself may earn a commission from the investment firms for recommending their services. These are considered among the popular business plans that cash advance apps often adhere to.

Pop-Up Alerts

In modern-day app development, instant notifications and pop-ups have become popular and have shown deliberate usefulness. The app uses these notifications and pop-ups to grab the user’s attention and insinuate them to take action. There are different instances where pop-up alerts and notifications are heavily used, such as app updates and other valuable info.

Support Center

As part of the financial service sector, a Cash Advance App must have a support center for its customers to express their concerns and appreciation alike. Cash Advance App Development process must include a proper system and team to manage the issues, complaints, problems, and even suggestions recorded by users. The app platform needs to take responsibility for their fall ous and acknowledge the customer’s side to help them solve the issue as far as possible.

Benefits Of Cash Advance App Development

Some of these app platforms even support no-interest rates, leaving users to pay the amount taken. Countless benefits can be linked to a Cash Advance App; let us look at a few advantages.

- The amount requested by the user is paid within a short time, like a day or so. This is the most significant thing about such an application; it understands and takes action for the urgency of the user.

- As a modern-day app for money lending, it has 24/7 service. Digital applications have made many things easier for folks, and money is just one instance.

- Cash Advance App Development is centered around borrowing advance money from their paycheck for the next month. Hence, the logical explanation might be not paying interest for borrowing one’s own hard-earned money. However, the user must pay the sum back once they have secured their paycheck.

- Often these applications do not care about the credit score of the customers. Thus, it also creates an opportunity for poor players to avail the services.

Cash Advance App Development – Factor Affecting The Costs

For Cash Advance App Development, any React native app development business would need hefty money. The price of some well-known “early payout applications” has given us a rough notion of how much it would cost to produce one. As a result, every Android app development business must first manage a sufficient number of funds to create such an app. Charges may differ depending on the circumstances. This is because producing an Android app is usually an expensive endeavour. Several extra prerequisites are needed to meet the requirements of building such an app. As a result, it is still preferable to begin building such Cash Advance App Development with sufficient funds.

Although developing an Android financial application is not straightforward, it is possible. You need a good team like WebRock Media and you can get the best user-friendly app for your business. And that too at affordable pricing.

The Need for Expertise

This work requires the participation of several expert android developers. Without expert assistance, it is impossible to materialise Cash Advance App Development. Such knowledgeable iOS or Android developers would want a high fee. The proper deployment of such financial app development also necessitates many QA professionals. Without a decent amount, none of this would be possible.

Technological Proficiency

It’s realistic to expect that a reasonable number will be required for the eventual Cash Advance App Development. Designers and project managers are also necessary for developing an Android app. It’s all about financial advances in this instance. As a result, the need for a financial analyst is exorbitant. When it comes to monetary transactions, you can’t escape interacting with banks. As a result, adequate financial support for app development is critical. Such operations can be achievable by appointing a competent and skilled project manager.

These project managers would only charge a nominal CTC while doing their duties. As a result, price is connected to every aspect of Cash Advance App Development. Because of their widespread appeal, Android app development companies have been encouraged to create more such apps.

Price supposition

Mobile app development services should also be familiarised with Cash Advance App Development. As a result, it is apparent from the preceding discussion that any “cash advance application” can only be produced with the help of competent analysts, software developers, and other specialists. It’s also a time-consuming task, and all of this would entail a significant financial investment. Assume a range of $20000 to $30000 for overall costs. However, the initial cost may change based on the numerous app development expenses.

Nonetheless, the entire cost of Cash Advance App Development is expected to fall within this range. Although app development businesses may use less expensive statistics to create such an app, such a cash advance app cannot be made for less than $20000.

Fluctuating Prices

The cost of Cash Advance App Development varies by country. The various costs and fees associated with launching such an app are subject to change. It has been noticed in numerous marketplaces leading to money lending, and the new paycheck app has varying costs in various locations. For assistance with Cash Advance App Development, any expert mobile app development would demand a significant fee.

If you want cost-effective solutions for your Fintech business, try connecting with us!

Conclusion

Modern-day applications are known for their simplistic approach and a viable way to continue financial businesses on both accounts. Money lending applications make it easier for users to find lenders willing to provide the requested amount. Cash Advance App Development considers every aspect of the money lending process and translates it digitally for users to avail of the services at their convenience.

I hope you enjoy reading this blog post.

Would you like to get expert advice? Schedule a Call

About Webrock Media

Webrock Media comes with an incredible team of website and mobile application developers who can customize the perfect solutions to transform your business. We think ourselves to be an ideal ‘Technology Simplified Destination’ as we know how to perfectly merge creativity and programming to build robust websites for our clients.