Payday Loan App Development- The Advanced Loan App

home / blog / Payday Loan App Development- The Advanced Loan App

Payday loans have been around for quite some time now and have made significant contributions to the Financial services industry. In such loans, the user is granted money by the platform in exchange for the assurance of the user paying it back on their payday. Digitalizing the whole scene, the Payday Loan App Development has eased the entire process and has made it more flexible.

The app platform has improvised the entire system of payday loan requests for the end-user while ensuring the business is also picking up pace. Such applications have a strategic workflow functionality, a legal business model, and exotic features to drive the entire thing in an organized way.

These applications can grant loans to corporate employees from their paychecks. Employees usually borrow the money before their payday and pay it back with interest when the remuneration finally gets credited to their bank accounts. Payday Loan App Development digitalizes the process, making it more technical and efficient.

Functionality Of Payday Loan App Development

As said before, the functionality or the workflow of a payday loan application has to be meticulous in its design and flexible in its implication. We say flexible because the workflow needs sufficient room for further inclusion and managing other nuances. The workflow entails the whole journey of the end-user and how it befalls.

- For Payday Loan App Development, you have to focus specifically on designing the registration process in a way that is simplistic in its approach and also gathers the necessary info the app requires to function.

- Once they have registered with their credentials, they will have to upload certain documents and get them verified. These are for identification purposes and for the app to keep track of the borrowed amount.

- A payday loan app draws money from the user’s upcoming paycheck. Hence, there is always a limit, which is most certainly below the total salary amount.

- Employees draw out the money closest to their payday. Hence, technically, they have already worked for the amount they are drawing out. The interest calculator will first calculate the amount users can borrow. Then it will further calculate the interest fee for favors taken from the app platform.

- These instances can only digitally happen by linking the user’s bank account with the app platform. Payday Loan App Development specifically emphasizes this part, as the salary account is what gives them the authentication from the user to provide approval for their loan requests.

- Once the account is linked, the user can look for loans. The calculator will automatically measure the amount that can be accessed, and if the user still approaches that, they might apply for the loan amount.

- The amount will be credited back to the user account almost immediately. The user can use it however they deem fit.

- As soon as the paycheck gets credited to the salary account of the user, the app dares to deduct the borrowed amount plus interest.

Payday Loan App Development User App Features

The app development process is, however, very technical. Everything has to be lined up in the project assessment, UI/UX design, back-end, and front-end development. The features included in such a platform are set in order through the UI/UX design. These features are also the direct representation of how the front-end will seem to the user. They help carry out the basic functionality or workflow of the app.

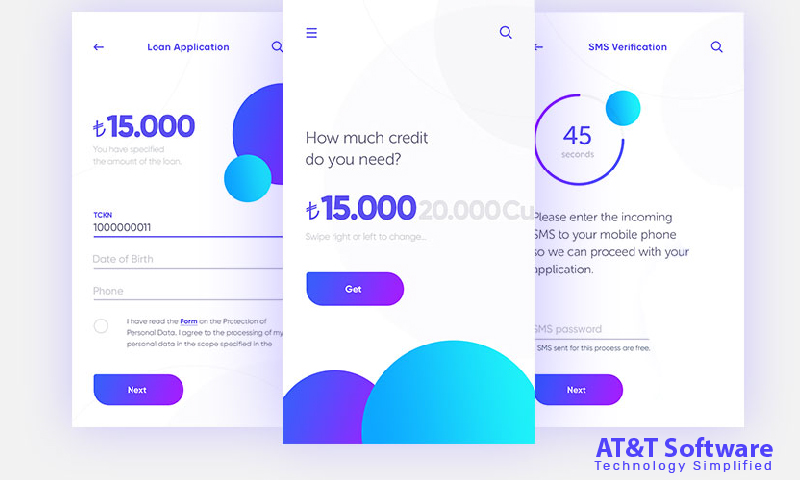

Registration

The workflow and app activity initiates with the user registration; hence this is the first instance that Payday Loan App Development needs to focus upon. By registering, the user can use the financial services provided by the platform. This simple process only requires users to add their email i.d or phone number and get verified to join the community. After the initial registration and verification of credentials, the user can just use the id and a password to log in from the next time onwards.

Creates Profile

After entering the platform, initially, the user will have to set up their user profile with relevant info. Users can update this profile whenever new info or some other change is required. The profile carries all the personal information entered by the user and the data generated during the user making a transaction. All records are stored under the profile.

Uploading Document

Payday Loan App Development has to have authentic input from the user. This includes the basic name, address, overall identification, and their bank account or salary account details so that the app can leverage it to deduct the amount borrowed when the time runs out. These documents are highly important, and the app needs to manage them with confidentiality.

Online KYC Verification

Among the info collected for identification purposes, the platform will verify them. The KYC info is crucial for the app platform. Basic identifications such as nationality and governmental information are required for financial services in general.

Loan Limit Calculator

There is a certain limit for every individual asking for a loan request. Since the application focuses on payday loans or advances, the limit is somewhere between the actual salary. The loan limit calculator can calculate the loan amount based not just on the paycheck but also on the ability of the user to pay back the amount.

Interest Rate

Since Payday Loan App Development cannot thrive without a business plan, including an interest rate is the best option. Such applications can charge interest of a minimal percentage from the user for borrowing the money. This interest rate gets added up when the app deducts the amount.

Loan Application

After the user has gone through this ordeal and is interested in the amount offered for the loan and the interest rate charged on the loan’s processing, they can present a request to the platform. The admin will look over this request, and the admin will send the approval or declination notice once they reach a decision.

Loan Status

Payday Loan App Development also has to include the loan status. Generally, the app quickly processes such requests; however, it takes a few moments to ensure the loan is given to a reliable individual. This approval is based on several factors, including the individual’s credit score. Every development will be recorded under the loan status during this loan processing period and until the amount gets paid.

Bank Account Linking

One of the first and foremost things that users will have is to link their bank accounts. They can also include their salary account, making it even more authentic. With the salary account being linked, the app can directly deduct the amount once the salary gets credited to the platform.

Auto-Debit

As said just now, the app can collect the borrowed amount directly from the user’s salary account. This feature is popularly known as auto-debit. This removed any risk involved in the payday loan application in a business sense. It also prevents the user from mission out on the deadline and straying away from paying a late fee, along with the borrowed amount and interest rate.

Push Notification

Payday Loan App Development like any other app development, has to include some sort of notification panel. Push notifications, pop-ups, alerts are a few ways the app can communicate and send necessary info to the user. For example, the app can send reminders as the due date approaches or when as soon as the amount gets debited from your salary.

Help & Support

The app needs to be able to provide help and support to its users. For which they can surely include a help or support center consisting of a professional team. Users may encounter technical or other problems which they need to share or discuss with professionals to resolve the issue. The help center is keen on listening to the user’s grievances and is determined to solve as many.

Notable Benefits Of Payday Loan App Development

Payday Loan App Development has several benefits to offer its users and the app business. These benefits are fundamental to understanding why developing such a platform is important.

- Like most modern-day applications of our time, this too has cloud storage. Cloud storage allows the app to store data in a separate place. Cloud storages are safe from data loss and thrift.

- These platforms can penetrate easily because they have a faster approach to the whole system. Users can apply for loans quicks and receive the approval of the request and the amount in a relatively short span.

- The app automates the whole process of loan management. Every instance is automated, from quick loan processing to payment, with a few clicks and taps required from the user.

- The app platform highly depended on analytical reports. Usually, an app’s survival depends on how fast it can analyze the platform and improve it for betterment.

Conclusion

During the tough times of COVID-19, while most business ventures were tumbling, the digital scene was drastically growing. With that growth, the demand for Payday Loan App Development also increased. With most financial services taking the digital route, it is important to mention the benefits of such platforms for the general public. With all that being said, it is quite understandable why developing such an application is important.

I hope you enjoy reading this blog post.

Would you like to get expert advice? Schedule a Call

About Webrock Media

Webrock Media comes with an incredible team of website and mobile application developers who can customize the perfect solutions to transform your business. We think ourselves to be an ideal ‘Technology Simplified Destination’ as we know how to perfectly merge creativity and programming to build robust websites for our clients.